Stronger Security Beyond Login

Ensure sensitive operations stay protected with advanced security and privacy controls, while maintaining a smooth and trusted user experience.

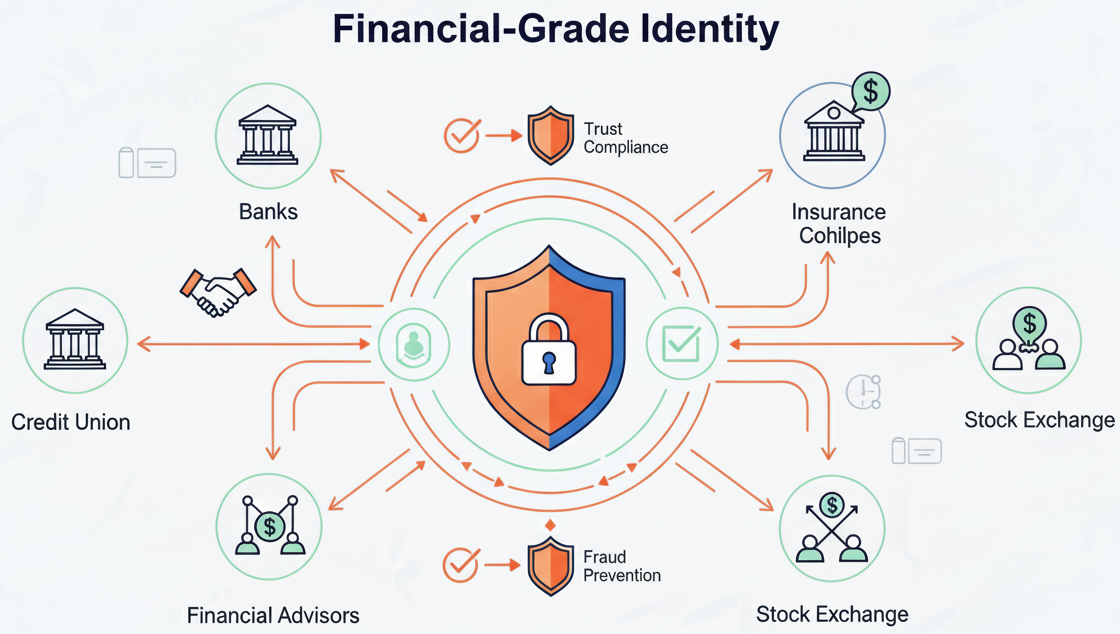

Secure every login and build customer trust. Banks, credit unions, insurers, advisors, and exchanges rely on SSO.iD to deliverem Identity™ — seamless access, robust fraud prevention, and compliance built in.

Streamline and secure access across your organization for your customers and members, so you can focus on moving your business forward.

Ensure sensitive operations stay protected with advanced security and privacy controls, while maintaining a smooth and trusted user experience.

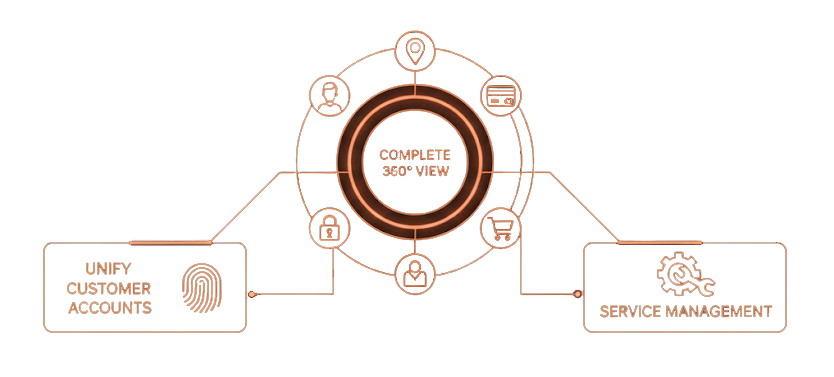

Unify customer accounts, build a complete 360° view, and deliver personalized access and service management for every user.

Unify customer accounts, build a complete 360° view, and deliver personalized access and service management for every user.

Protect customer identities with adaptive authentication and intelligent threat detection that prevents fraud and data breaches—while minimizing friction for legitimate users.

SSO.id powers CIAM for financial services with security and simplicity.

Provide stronger, more efficient customer identity solutions that simplify compliance, enhance security, and protect against fraud across both digital and physical interactions.

Deliver seamless digital experiences that keep insurance agents productive and customers engaged, while ensuring strong protection for sensitive policy and personal data.

Ensure stronger trust and deliver seamless, tailored interactions that not only simplify access but also elevate every client experience beyond expectations.

Address critical security, performance, and user experience needs while driving faster innovation, reaching broader markets, and strengthening platform resilience.